The AI-Powered Treasury Execution Platform

Stop portal-hopping.

Start commanding cash.

Stop portal-hopping.

Start commanding cash.

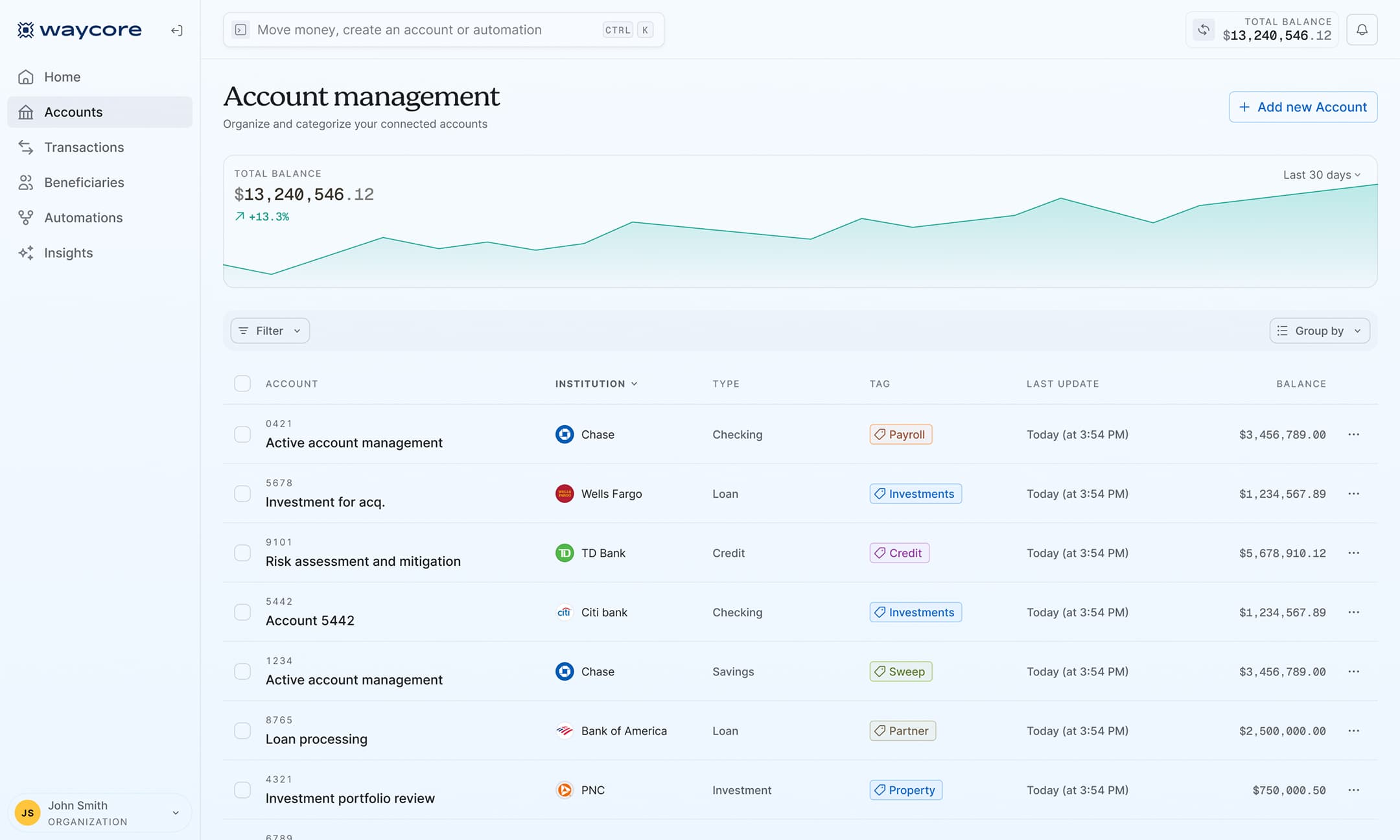

Waycore unifies cash across your existing banks, automates transfers and sweeps, and reconciles activity to your ledger.

Waycore unifies cash across your existing banks, automates transfers and sweeps, and reconciles activity to your ledger. All from a single command interface.

Fix the manual cash work that consumes your teams' time

Fix the manual cash work that consumes your teams' time

Replace error-prone logins, spreadsheets, and copy-pasted transfers with a single execution layer that mirrors how your banks already work.

Global Visibility

Waycore logs into every bank to build a real-time view of global cash.

Draft Payments & Transfers

Type "sweep $250k to BofA." Waycore initiates it natively at your bank.

Batch Execution

Parses and executes complex instructions like 90 line spreadsheets.

Recurring Workflows

Automates actions like sweeps, waterfalls, and debt service coverage.

Continuous Reconciliation

Matches bank activity to your ledger, daily or weekly.

Audit Trail

Records who initiated, who approved, what changed, and what executed.

command. Review. approve.

Draft with AI speed

Approve with CFO control

Draft with AI speed

Approve with CFO control

Turn intention into action securely; from simple transfers, to complex, multi-step, conditional logic ones. We initiate at your bank portal, you approve.

COMMAND BAR

The engine

Don't buy

another dashboard

Don't buy another dashboard

Replace portal hopping with AI that unifies your workflows. Zero-trust execution 24/7.

- Eliminate manual login cycles and spreadsheet reporting

- Relieve key-person dependency and bottlenecks

- Reduce errors, overdrafts, and last-minute panic

- Scale operations and unlock yield without sacrificing efficiency

The guardrails

Control, safety, and auditability by design

Control, safety, and auditability by design

Waycore logs in as a dedicated bank user you create, governed by MFA, limits, and approvals.

- Recommended setup

- Internal transfers: Auto-execute (faster operations)

- External payments: Require bank approval (extra security layer)

- You control the permissions. You can adjust them anytime.

Who This Is For

Built for multi-account, multi-entity complexity

Built for multi-account, multi-entity complexity

If you manage 10+ bank accounts and log into multiple portals daily, manual execution is your bottleneck.

Payment operators & processors

Weekly settlements, reserves, payouts, internal batch flows.

Property managers & Real Estate operators

Sweeps, distributions, project funding, entity-to-entity flows.

Family offices & fund administrators

Trusts, hold cos, tax entities, investment flows.

Platforms with merchant or virtual accounts

Merchant balances, escrow-like flows, multi-party payouts.

Vertical SaaS with payout or treasury components

Hospitality, gig, logistics, healthcare RCM, marketplaces.

Meet waycore

Book a demo

Book a demo

We are onboarding a limited number of multi-entity finance teams to our white-glove pilot program. We'll get you live in days with hands-on support.

Schedule now

Bank-enforced Permissions

No Credential Sharing

Full Audit Trail